Test Your Impact Investing Smarts

Test Your Impact Investing Smarts

I’m Katherine. I’m a CERTIFIED FINANCIAL PLANNER™, a financial advisor for inheritance, and a fellow inheritor.

Each week on my Instagram page I create a quiz for current and future inheritors to test their knowledge.

Now, I’m bringing these quizzes to the blog.

Read here to test your knowledge and see how you did compared to my 10,000 Instagram followers.

Posted on July 16, 2025 by Katherine Fox.

How Do You Start Impact or ESG Investing?

Many of the inheritors I work with want to “invest for good.”

You might call this ESG Investing, Socially Responsible Investing, Impact Investing, Values Aligned Investing, whatever.

Honestly, the name doesn’t matter. The point is that you want to get rid of that gross feeling that comes up everytime you remember that your electric car definitely doesn’t offset all the money you have invested in oil and gas companies.

But how do you get started?

Imagine you’re in a traditional portfolio right now.

You’ve done a comprehensive portfolio review (hint: book a call for this FREE review) and realize you have a LOT of terrible companies in your investment holdings.

We’re talking about weapons manufacturers, oil and gas companies, private prisons, the whole bit.

If you’re not paying attention, you are almost certainly invested in some of the world’s most polluting companies, and some of those with the worst human rights track records.

You want to move your money into less egregiously terrible companies and are especially interested in investing in solar and clean energy.

But you’ve been hearing so much about Trump attacking these companies.

You’re worried you’re going to lose money if you move into “better” investments.

What should you do?

Here are some options for getting started with Impact or ESG Investing.

Which would you choose?

A.lYou’ve only got $5 million to invest. In the scheme of things, that’s a drop in the bucket. Leave your portfolio alone.

B. Think about what industries you are and are not comfortable with and decide how much risk you’re willing to take to meet your investing goals.

C. Sell everything in your portfolio and move entirely into direct investments in clean energy companies and funds off Wall Street.

D. Research the best clean energy companies and sell a portion of your “bad” companies to invest in these new companies. Keep the rest of your money as is in case those clean energy bets don’t do well.

“It’s a persistent, unfortunate myth that Impact or ESG Investing involves sacrificing return.

While an ESG portfolio may differ from its benchmark due to sector exposure (for example, the portfolio may not own oil and gas companies) that doesn’t mean accepting lower returns.

It does mean having confidence in your portfolio’s ability to return over time because the companies you own are making bets on business practices that are sustainable over the long term. ”

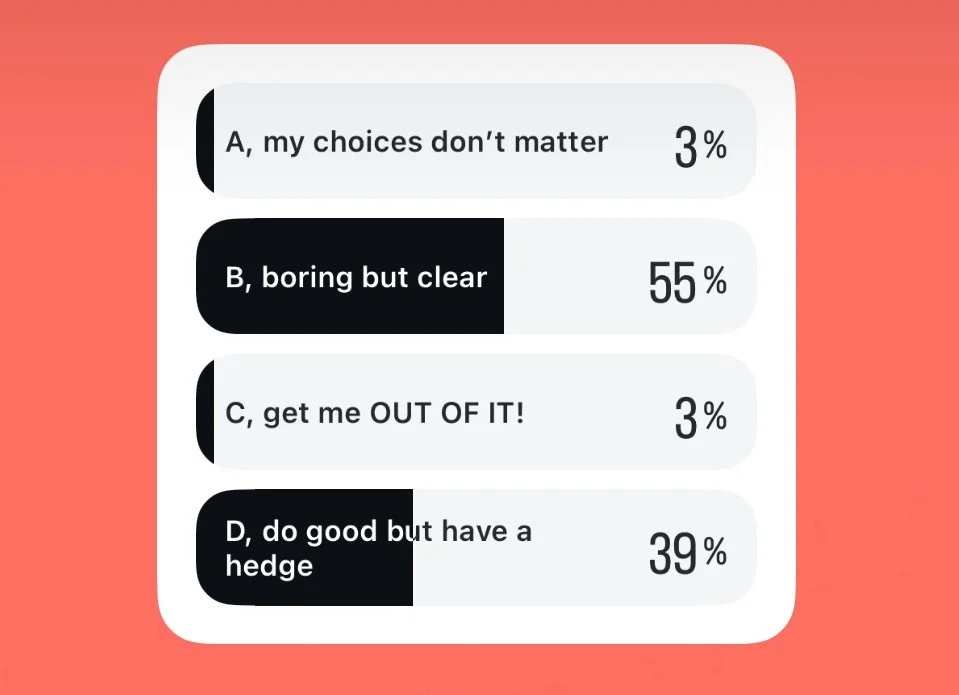

What did my 10,000 followers think?

Did they get it right?

In my mind, absolutely.

Option B is the correct choice.

Here’s why:

Option A is too fatalistic for my taste. Your $5 million alone won’t move the needle, but if everyone thought like that our world would never get anywhere. It takes one person making a change to inspire others, you never know where that is going to lead.

Beyond that fact, a solidly constructed Impact or ESG Investing plan should include proxy voting. Proxy voting allows shareholders to make their opinions known to, and influence the policies of, large companies. Adding your voice to those votes matters.

Option C is a solid option, but it involves hard work and research, illiquidity, and a significant amount of risk. While many investors do choose to take their investments off Wall Street to create greater impact, it isn’t the first choice for most inheritors.

Instead of going fully off Wall Street, investors may choose to direct a portion of their investments to lower-return, higher-impact opportunities. These investment options are available to Sunnybranch clients and are evaluated as part of your overall financial plan.

Option D is full of pitfalls. Rather than making direct investments and bets in specific companies, I advocate for building a full impact portfolio. Clean energy companies will be a part of your portfolio, but you remain appropriately diversified in the event of poor returns from those companies.

It’s a persistent, unfortunate myth that Impact or ESG Investing involves sacrificing return. While an ESG portfolio may differ from its benchmark due to sector exposure (for example, the portfolio may not own oil and gas companies) that doesn’t mean accepting lower returns. It does mean having confidence in your portfolio’s ability to return over time because the companies you own are making bets on business practices that are sustainable over the long term.

So now we’re at the correct choice, Option B.

Any well-constructed Impact or ESG Investing plan needs to start with an analysis of what values are most important to you and how much risk you’re willing to take. If you’re extremely risk tolerant, don’t need a lot of investment return, and place a high value on creating positive good with your investments, going fully off Wall Street may be the right fit.

For most inheritors, however, this isn’t the path. Instead, they want a portfolio that screens out the bad actors and places a greater emphasis on companies creating positive change.

This portfolio should have well-balanced holdings of companies of different sizes and invest in companies across the globe.

Are you ready to start investing in line with your values?

Book a FREE intro call to chat about what’s most important to you and get your portfolio analysis detailing what you hold now and my recommendations to start creating a positive impact with your investments.

Let’s take the next step together

Understanding how to create a positive impact with your inheritance is not easy. Inheritors can encounter a wide variety of different situations requiring knowledge and finesse to manage. If you need more help, you can download The 20 Inheritance Terms You Need to Know, or reach out to Katherine Fox, CFP® and CAP®, a fiduciary, fee-only financial planner to learn how Sunnybranch can help you build a plan to align your inherited investments with your values.